Tickmill is the trading name of the Tickmill Group, which includes several regulated entities across different jurisdictions. These include Tickmill UK Ltd, authorized by the Financial Conduct Authority (FCA) in the UK; Tickmill Europe Ltd, regulated by the Cyprus Securities and Exchange Commission (CySEC); Tickmill South Africa (Pty) Ltd, authorized by the Financial Sector Conduct Authority (FSCA); Tickmill Ltd, regulated by the Financial Services Authority (FSA) in Seychelles; and Tickmill Asia Ltd, regulated by the Labuan Financial Services Authority (LFSA) in Malaysia. Tickmill offers competitive trading conditions with spreads starting from 0.0 pips, no requotes, and a high level of fund security. Traders can access a wide range of financial instruments, including over 60 currency pairs, more than 500 CFDs on stocks, ETFs, commodities, precious metals, and cryptocurrencies. The broker supports all trading strategies, such as scalping, hedging, arbitrage, and algorithmic trading. Tickmill offers three types of accounts to cater to different trading needs. The Classic Account, starting from $100, is ideal for beginners who prefer commission-free trading. The Raw Account, also starting from $100, is designed for more experienced traders who seek low-cost trading with tighter spreads. Additionally, the Islamic Account provides a swap-free trading option, specifically tailored for Muslim clients who wish to trade in compliance with Sharia law.

Tickmill is the trading name of the Tickmill Group, which includes several regulated entities across different jurisdictions. These include Tickmill UK Ltd, authorized by the Financial Conduct Authority (FCA) in the UK; Tickmill Europe Ltd, regulated by the Cyprus Securities and Exchange Commission (CySEC); Tickmill South Africa (Pty) Ltd, authorized by the Financial Sector Conduct Authority (FSCA); Tickmill Ltd, regulated by the Financial Services Authority (FSA) in Seychelles; and Tickmill Asia Ltd, regulated by the Labuan Financial Services Authority (LFSA) in Malaysia. Tickmill offers competitive trading conditions with spreads starting from 0.0 pips, no requotes, and a high level of fund security. Traders can access a wide range of financial instruments, including over 60 currency pairs, more than 500 CFDs on stocks, ETFs, commodities, precious metals, and cryptocurrencies. The broker supports all trading strategies, such as scalping, hedging, arbitrage, and algorithmic trading. Tickmill offers three types of accounts to cater to different trading needs. The Classic Account, starting from $100, is ideal for beginners who prefer commission-free trading. The Raw Account, also starting from $100, is designed for more experienced traders who seek low-cost trading with tighter spreads. Additionally, the Islamic Account provides a swap-free trading option, specifically tailored for Muslim clients who wish to trade in compliance with Sharia law.

Tickmill – Safety of Funds

- Tickmill Group is a multi-regulated group of companies

- clients funds are insured with Lloyd’s from $20,000 to $1,000,000 in the event of insolvency

- Tickmill Europe Ltd is an official member of the Investor Compensation Fund (ICF) of Cyprus

- Tickmill keeps its clients funds in segregated accounts with trusted financial institutions

Open Real Account

Basic information about Tickmill | |

|---|---|

| Website | |

| Founded | 2014 |

| Headquarters | United Kingdom, Republic of Seychelles, Cyprus, South Africa, Malaysia |

| Regulations | |

| Scalping | |

| Hedging | |

| Deposit and withdrawal methods | Bank Wire Transfer, Credit Card, Skrill, Neteller, fasapay, UnionPay, Dotpay |

| Website languages | English, Arabic, Chinese, Chinese Traditional, German, Indonesian, Italian, Korean, Malay, Polish, Portuguese, Russian, Spanish, Thai, Vietnamese |

| No services | |

| Islamic Account | |

| Demo account | |

Types of Tickmill accounts | ||

|---|---|---|

| Name | ||

| Minimum deposit | ||

| Maximum leverage | 1:500 (Pro Clients) | 1:500 (Pro Clients) |

| Minimum position | ||

| Account currencies | ||

| Platforms | ||

| Spreads | ||

| EUR/USD | ||

| Commission | ||

Trading instruments (CFDs) | |||

|---|---|---|---|

| Currency pairs | Precious metals | ||

| Stocks | Energies | ||

| Indices | Bonds | ||

| Commodities | Cryptocurrencies | ||

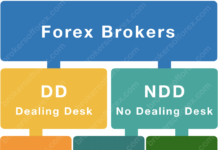

List of Forex Brokers